Basic Deposit Products:

Through this account, the Bank intends to help on-board clients with minimal identification requirements onto the financial system, thereby enabling them and shall enable the Bank to actively participate in the financial inclusion program of the Bangko Sentral ng Pilipinas.

With no maintaining balance but for a maximum deposit balance of 50,000.00, the account also bears no dormancy charges requirements. As such, the product is best for students, micro entrepreneurs, farmers, fisherfolks and other community-based clients who wish to save and transact money in a safe, convenient and hassle-free manner without the burden of having to provide extensive documentary requirements or even deposit maintaining balance.

The Basic Deposit Products will open up clients’ access to wider range of financial services offered by BHF Bank.

BHF Junior Saver

✓ This sub-classification of Basic Deposit Account (BDA) is available to any individual at least seven (7) years of age but not older than seventeen (17) years old at the time of opening the account.

✓ Best for student-depositors.

BHF Saver

✓ This sub-classification of Basic Deposit Account (BDA) is available to any individual at least eighteen (18) years of age.

Regular Savings

The Product is an interest-bearing savings deposit withdrawable anytime upon accomplishment of withdrawal slip and upon presentation of the passbook.

It offers utmost flexibility in terms of the depositor’s use of his/her hard-earned money while ensuring risk-free safekeeping in the Bank.

Best for private individuals, micro-entrepreneurs, professionals and businessmen who wish to save and deposit excess funds but want the funds to be readily available anytime.

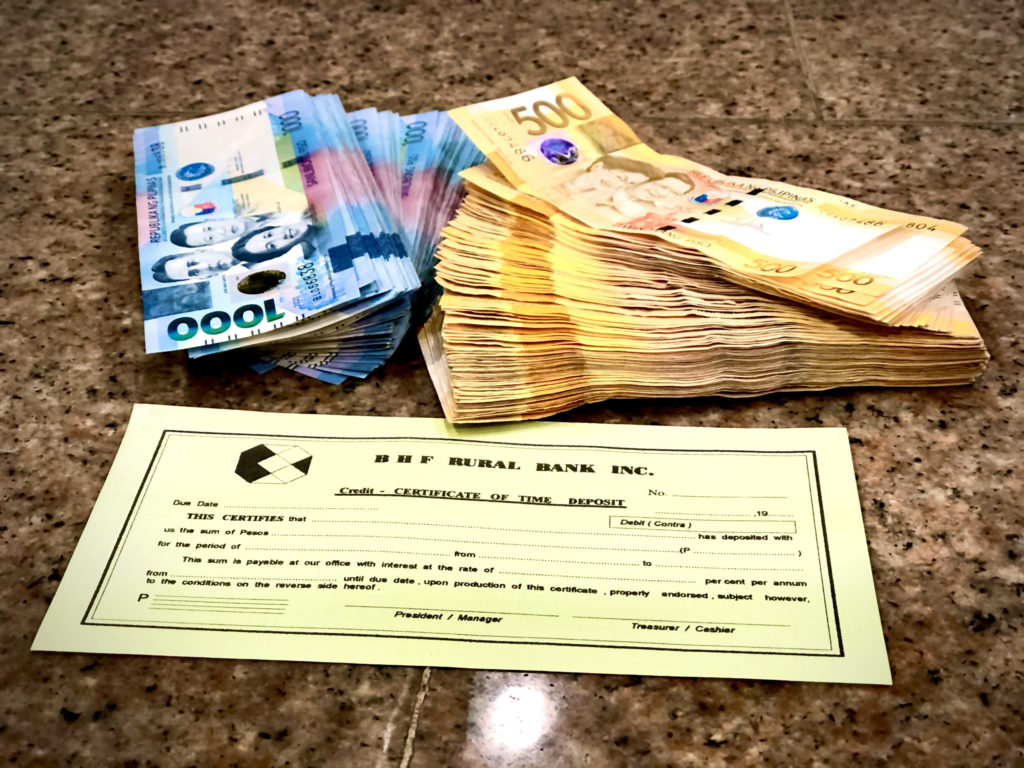

Time Deposit

The Product is an interest-bearing deposit with specific maturity date and evidenced by a Certificate of Time Deposit (CTD) in the name of Depositor(s).

Best for private individuals, micro-entrepreneurs, professionals and businessmen who wish to save and deposit excess funds in a specified period of time with a higher rate of return.

The long-term (5 years and 1 day) Time Deposit of the Bank is a high-yielding and tax free (*) deposit account. Corporate Accounts, however, are taxable.

Deposits are insured by PDIC up to ₱1 Million per depositor.